- Finterview

- Posts

- 📉 Tesla Stock Takes Another Tumble

📉 Tesla Stock Takes Another Tumble

When did you have to think outside the box?

⏱ Reading Time: 2 Minutes 58 Seconds

Happy Wednesday, future bankers!

Hope everyone is doing well! Today we’re covering some accounting concepts, a time that you had to think outside the box, and Tesla’s latest tumble.

🚀 Let’s get into it.

🔢 Technical Question

Gif by travisband on Giphy

Walk me through the effects that a $100 increase in depreciation has on the three financial statements.

Let’s walk through the three financial statements: the income statement, the balance sheet, and the cash flow statement.

Income Statement: An increase in depreciation by $100 is an expense, so it reduces your pre-tax income by $100. Assuming a 30% tax rate, your taxes decrease by $30 ($100 * 30%). Therefore, your net income decreases by $70 ($100 - $30).

Balance Sheet: On the asset side, the increase in depreciation reduces your net plant, property, and equipment (PP&E) by $100. On the liabilities and equity side, the decrease in net income reduces retained earnings by $70. This means your balance sheet is out of balance by $30 ($100 - $70).

Cash Flow Statement: The decrease in net income reduces your cash from operations by $70. However, depreciation is a non-cash expense that you add back in the cash flow from operations section, so you add back the full $100. This results in a net increase in cash of $30 ($100 - $70).

So, in summary, a $100 increase in depreciation decreases net income by $70, decreases net PP&E by $100, and increases cash by $30. This keeps everything in balance. This is a simplified explanation and actual financial statements can be more complex, but this gives you the basic idea of how depreciation affects the three financial statements.

🗣 Behavioral Question

Gif by lilly on Giphy

Can you share an instance where you had to think outside the box to solve a problem?

here are some best practices for responding to the question: “Can you share an instance where you had to think outside the box to solve a problem?” in the context of an investment banking internship interview:

Contextualize: Start by setting the scene for the problem you faced. This could be a challenging project, a tight deadline, or a complex financial model that needed to be developed.

Specificity: Be specific about the problem. What was the challenge? Why was it significant? What were the potential implications if it wasn’t resolved?

Action: Describe the innovative or unconventional approach you took to address the problem. This could involve a unique financial modeling technique, a creative negotiation strategy, or an unusual way of organizing data.

Result: Discuss the outcome of your actions. Did your solution work? What was the impact on the project or the team? If possible, quantify the results to highlight the effectiveness of your solution.

Reflection: Reflect on what you learned from the experience. How did it help you grow as a professional? What skills or insights did you gain that could be valuable in an investment banking context?

Remember, the goal is to demonstrate your problem-solving skills, creativity, and ability to thrive in challenging situations. Be honest and use a real example from your past experiences. The more specific and detailed you are, the more convincing your answer will be.

🗞 Industry News

📉 Tesla Stock Takes Another Tumble

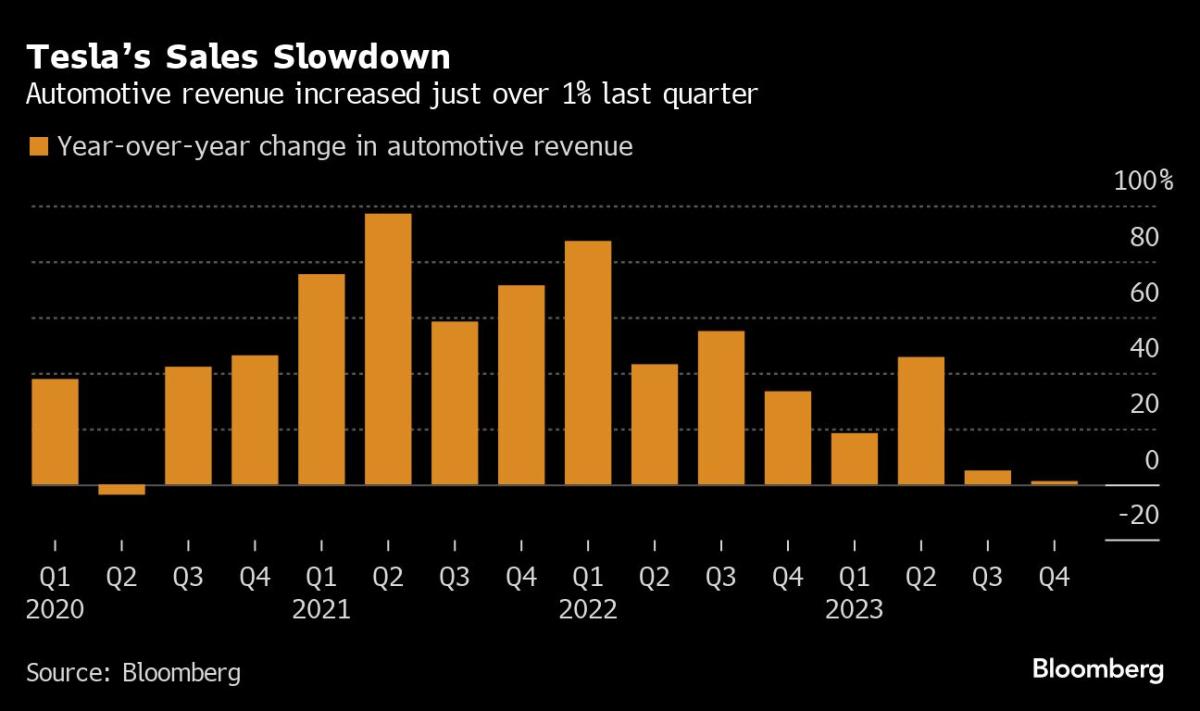

Tesla, once a red-hot growth stock, is now facing a grim sales prediction from Wells Fargo’s Colin Langan, who forecasts zero growth in sales volumes for the electric-vehicle maker this year, and a drop in volumes by 2025. This prediction led to a 4.1% drop in Tesla’s shares, reaching a 10-month low. The company’s stock has fallen 31% this year, contrasting with the S&P 500 Index’s 8.5% rise.

The market is questioning Tesla’s high valuation as the company’s expansion pace in revenue and profit has significantly slowed since last year. Wall Street has been skeptical about Tesla since March, following disappointing numbers from China, data from European countries, and a production disruption at its Berlin factory. These factors suggest that Tesla’s first-quarter deliveries may miss analysts’ average expectations.

CEO Elon Musk’s strategy of lowering prices to boost demand is losing its effectiveness. Langan notes that Tesla’s growth in its core markets has moderated and downgraded the stock to a sell rating. He describes Tesla as a “growth company with no growth,” highlighting that sales volumes rose only 3% in the second half of 2023 from the first half, while prices fell 5%.

Read more about this story below.

Thanks for tuning in today! Best of luck to everyone working through recruiting right now. If you sign an offer, reply to this email and let us know about it! Like seriously, do it—we’d love to hear about it!

-The Finterview Team