- Finterview

- Posts

- Dell Stock Surges 30% 💻

Dell Stock Surges 30% 💻

Calculating IRRs with mental math...

⏱ Reading Time: 3 Minutes 7 Seconds

Happy Friday, future bankers!

Hope everyone is doing well and enjoying their start to March! Today we’re covering how to calculate IRRs, how to talk about your weaknesses, and giving an update on the surge in Dell’s stock price.

🚀 Let’s get into it.

🔢 Technical Question

Gif by travisband on Giphy

If you purchased a company for $100M, and then went on to sell it for $200M 5 years later, what would be your IRR?

The Internal Rate of Return (IRR) is the discount rate that makes the Net Present Value (NPV) of a series of cash flows equal to zero. In this case, you’re buying a company for $100M (an outflow), and selling it for $200M (an inflow) 5 years later.

The Rule of 72 is a simple way to estimate the time it takes for an investment to double given a fixed annual rate of interest. You divide 72 by the annual rate of return you receive on your investment.

However, in this case, we’re doing the reverse. We know the investment has doubled in 5 years, and we want to find out the annual rate of return (the IRR). So we can rearrange the Rule of 72 to solve for the IRR:

IRR = 72 / 5 = 14.4

So, the IRR for this investment is approximately 14.4%.

Please note that the Rule of 72 is an approximation. For a more precise calculation of IRR, you would need to use the IRR function in a financial calculator or spreadsheet software, which solves for the exact discount rate that sets the NPV of the cash flows to zero. However, in the context of an interview, using the Rule of 72 demonstrates a quick and practical understanding of financial concepts.

🗣 Behavioral Question

Gif by lilly on Giphy

What’s your greatest weakness?

When responding to this question it’s important to be honest, but also strategic. Here are some best practices:

Self-awareness: Show that you’re self-aware and understand areas where you could improve. This demonstrates humility and a willingness to learn and grow.

Relevance: Choose a weakness that is relevant but not critical to the job. For example, if you’re applying for an analyst position, don’t say you’re bad at numbers.

Specificity: Be specific. Instead of saying, “I’m not a good public speaker,” you could say, “I sometimes struggle with presenting to large groups.”

Progress: Discuss what steps you’ve taken to improve this weakness. This shows that you’re proactive and committed to personal development.

For example, you might say: “One area I’m working on is my public speaking skills. While I’m comfortable in small group settings, I can get nervous when presenting to larger groups. To improve, I’ve joined a debate club at my school to gain more experience and receive constructive feedback. I’ve already noticed some improvement and feel more confident in my ability to communicate my ideas clearly.”

Remember, the goal is not to turn a negative into a positive (e.g., “I work too hard”), but to demonstrate that you can reflect on yourself and strive for self-improvement. It’s about showing your potential as a valuable addition to their team.

🗞 Industry News

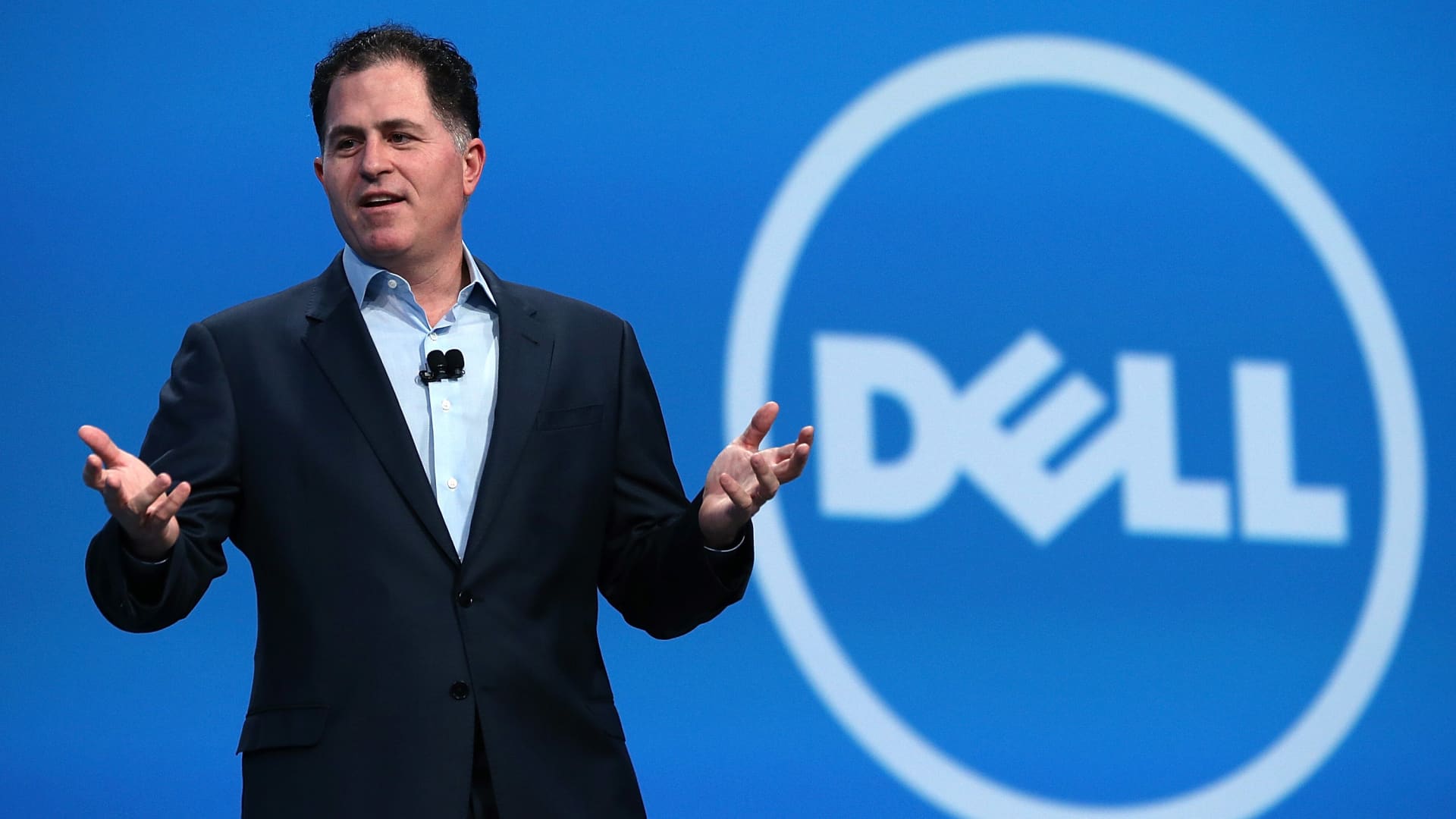

Dell Stock Surges 30% 💻

Dell is having a fantastic day on the stock market – its best since returning in 2018, The company surprised everyone with its latest financial report, beating expectations for both revenue and earnings. Clearly, investors are happy with Dell's results.

A big part of Dell's success is due to strong demand for its artificial intelligence servers. The company is rewarding investors with a bigger dividend and looks forward to a strong start for the next quarter. Since going public again in 2018, Dell's value has skyrocketed, making it a market darling. Analysts are excited too, with firms like Morgan Stanley and Wells Fargo giving Dell a thumbs up and feeling optimistic about its AI potential.

Read more about this story below.

Refer 3 Friends ➡️ Get Access to Database of 100+ IB Career Pages

Refer Friends: If you manage to get three of your friends to sign up for Finterview, we have a special offer for you. We’ll send you a curated database of links to the career pages of 100+ (and growing) investment banks. This way, you can streamline your search for new internships.

How It Works: All you need to do is reply to this email and list the email addresses of the friends you referred. Once we receive your reply and verify the sign-ups, we’ll email you the comprehensive list.

Questions or Clarifications: If you have any questions or need further assistance, feel free to reply to this email. We’re here to help! 🌟

Thanks for tuning in today! Best of luck to everyone working through recruiting right now. If you sign an offer, reply to this email and let us know about it! Like seriously, do it—we’d love to hear about it!

-The Finterview Team